32 Day Notice Account

Our Deposit Accounts allow you the freedom to save separately to your share account while earning a guaranteed return.

You need to have €10 in your share account to open a deposit account. The most that you can hold between all your savings’ accounts with us is €100,000

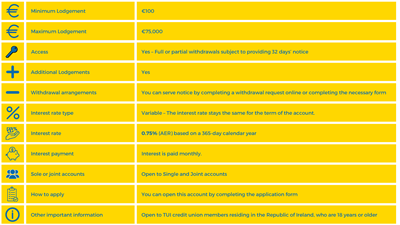

Please see details of our 32 Day Notice Account which can be opened at any time.

32 Day Notice Account - Product Information

This deposit is for those that want to keep their funds accessible within 32 Days but would like to earn a little interest. You can only access the funds on the expiry of 32-days written notice. There is no end date on this account.

The interest rate is variable and is paid monthly.

How to apply

Complete the relevant application form and a member of staff will confirm the details.

Members will need to provide the following documentation when applying for the Deposit Accounts:

- Proof of ID

- Proof of Address

- Proof of PPSN